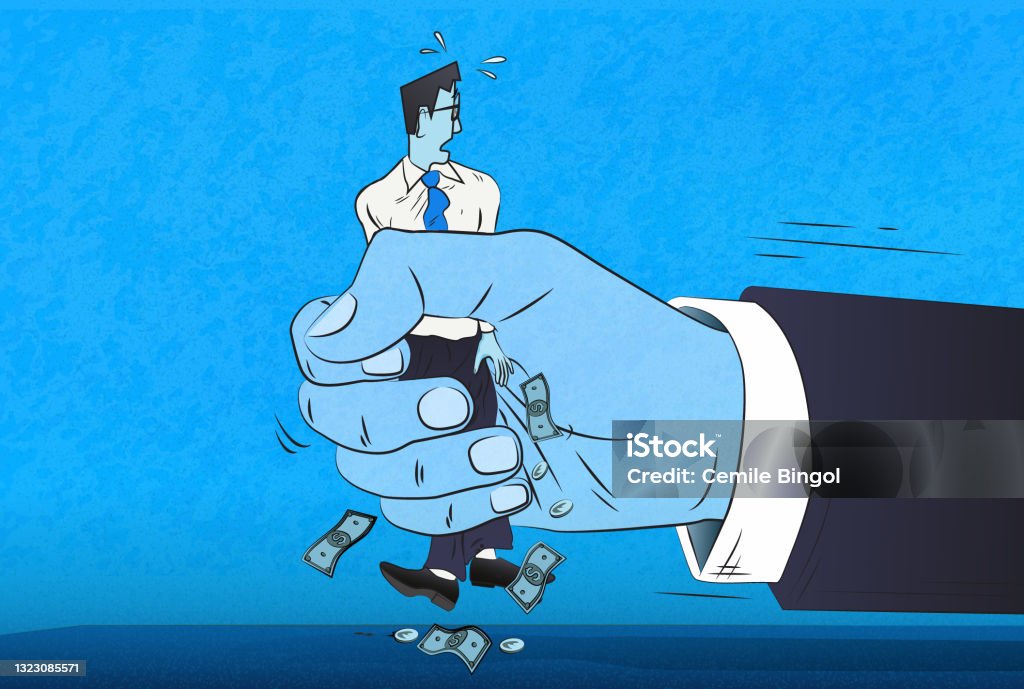

The Financial Trap

Starting a

new job is an exciting phase in life, filled with aspirations and dreams.

However, in the pursuit of fulfilling those aspirations, many individuals fall

into a financial trap that affects their career choices, creativity, and

overall well-being. This blog explores the common patterns that lead to this

trap and sheds light on the long-term consequences individuals face as they

find themselves stuck in a cycle of loans and EMIs.

The

Initial Desires and Loans:

As people

embark on their careers, they often have basic necessities to address. However,

the desire for luxuries and fulfilling personal desires can lead them to take

loans. These loans, although initially satisfying, can turn into a burden that

haunts individuals for a significant part of their lives.

The EMI

Fear and Stifled Creativity:

As the

weight of EMIs starts to loom over individuals, fear and anxiety kick in. The

constant worry about meeting financial obligations can suppress their creative

instincts. The focus shifts from exploring new avenues and pursuing passions to

solely working to pay off the EMIs, leaving little room for personal growth and

fulfilment.

Stuck in

Unfulfilling Jobs:

The

pressure to maintain a steady income to manage loan repayments often forces

individuals to remain in jobs they do not enjoy. Even if they harbor a dislike

for their work or lack passion for their profession, they continue down the

path, compromising their happiness and sense of fulfilment.

The Cost

of Lost Freedom and Peace:

As the

years go by, the trap tightens its grip. Individuals find themselves trapped in

a monotonous routine, akin to machines. The loss of freedom and peace takes a

toll on their mental and emotional well-being, leading to increased stress and

discontentment.

Breaking

Free from the Trap:

Escaping

the financial trap is not an easy task, but it is possible. It requires careful

financial planning, disciplined saving, and a shift in mindset. Individuals

must prioritize their long-term well-being over short-term gratification and

actively work towards reducing debt and building a secure financial future.

The

financial trap is a common pitfall that many individuals fall into as they

strive to fulfill their aspirations. However, it is crucial to be mindful of

the long-term consequences and make informed decisions. By understanding the

impact of loans and EMIs on career choices, creativity, and overall well-being,

individuals can take proactive steps to break free from the trap and create a

more fulfilling and balanced life.

Comments

Post a Comment